In the dynamic world of finance, particularly in Forex trading, one term frequently emerges as both a powerful ally and a formidable foe: leverage. For anyone looking to understand how to trade with leverage or seeking to enhance their trading strategies, comprehending this concept is paramount. Leverage is a mechanism that can multiply your purchasing power, allowing you to control significantly larger positions in the market than your initial capital would otherwise permit. While it offers the enticing prospect of magnified profits, it also carries the inherent risk of amplified losses, making it a “double-edged sword” in the hands of traders.

This comprehensive guide will explain what leverage is, its fundamental principles, how it specifically operates within the Forex market, the substantial risks involved, and crucially, how to employ effective risk management strategies to navigate its complexities responsibly.

Understanding the Core Concept: What is Financial Leverage?

At its heart, financial leverage is the use of borrowed money (capital) to finance an activity with the expectation that the returns from that activity will exceed the cost of borrowing. Simply put, it’s like taking a loan to invest. This concept isn’t exclusive to trading; it’s prevalent across various financial scenarios. For instance, when an individual takes out a bank loan to purchase a house to rent out, they are leveraging their investment. Similarly, a company seeking financing to expand its operations is using leverage, as is a government borrowing from the International Monetary Fund (IMF) to improve its economy.

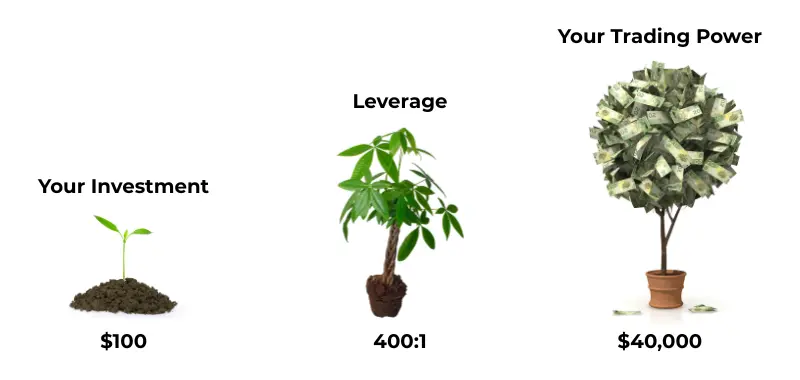

In the context of trading, leverage works by a broker providing a temporary loan to a trader, allowing them to open positions much larger than their deposited funds. The money a trader contributes from their own capital is known as ‘margin’, which serves as collateral for this borrowed credit. Therefore, leverage trading is essentially synonymous with ‘margin trading’.

Mathematically, the leverage formula is calculated as the total investment divided by the capital owned (margin). For example, if you invest €1,000 in a stock with only €200 of your own margin, you are effectively using a leverage of 1:5 (€1,000 / €200 = 5). This mechanism enables traders to increase their market exposure while committing a reduced percentage of their own capital to the entire position.

Leverage in Forex Trading: The Specifics

The Forex market stands as the largest financial market globally, facilitating over $5 trillion worth of currency exchanges daily. Traders engage in buying and selling currency exchange rates, aiming to profit from favorable movements in these rates.

The Role of Lot Sizes and Pips in Forex

To grasp how leverage works in Forex, it’s essential to understand pips and lot sizes.

• A pip (percentage in point) is the smallest unit of price movement in a currency pair. For most major currency pairs, such as EUR/USD, a pip is the fourth decimal place. For example, if the EUR/USD rate moves from 1.17835 to 1.17845, it has increased by 1 pip.

• Lot sizes determine the value assigned to each pip, dictating the volume of currency being traded. There are three primary lot sizes:

◦ Micro Lot (0.01): Represents 1,000 units of the base currency. If your base currency is USD, a micro lot typically means a gain or loss of $0.10 per pip.

◦ Mini Lot (0.10): Represents 10,000 units. Being ten times larger than a micro lot, it corresponds to approximately $1.00 per pip (for USD base currency).

◦ Standard Lot (1.00): Represents 100,000 units of the base currency. This is ten times a mini lot, resulting in roughly $10.00 per pip (for USD base currency).

Without leverage, to execute a standard lot trade in EUR/USD, you would theoretically need to have approximately $117,835 in physical currency to cover the trade’s notional value. Since this is largely unfeasible for the average retail trader, leverage steps in “to the rescue” by making such large positions accessible with a smaller capital outlay. It’s crucial for traders to research the exact pip values, as they can differ based on the broker and the specific currency pair being traded.

Leverage Ratios and Margin Requirements

Leverage is essentially a loan from your broker that allows you to control a larger market position. To initiate a leveraged trade, you are required to deposit a certain percentage of the trade’s total value as initial margin. This margin acts as collateral, ensuring you can cover potential losses.

The leverage ratio illustrates the extent to which your trade size is magnified compared to your margin. For example, with a 100:1 leverage ratio, a deposit of just $1,000 as margin enables you to control a position worth $100,000. This implies a 1% margin requirement ($1,000 / $100,000).

Common leverage ratios and their corresponding margin requirements include:

• 50:1 leverage: Requires a 2% margin.

• 100:1 leverage: Requires a 1% margin.

• 200:1 leverage: Requires a 0.5% margin.

As evident, a lower margin requirement translates to a greater amount of leverage available for each trade. However, brokers may increase margin requirements for more volatile currency pairs (like GBP/JPY) or during periods of heightened market volatility to manage their own risk. They might also impose higher margin requirements for emerging market currencies, such as the Mexican peso, even with lower leverage ratios like 20:1.

How Leverage Magnifies Profits: A Practical Example

Let’s illustrate how leverage can boost your returns. Suppose you have $1,000 to invest and your broker offers a 1:5 leverage.

1. Instead of just using your $1,000, the 1:5 leverage means your broker effectively lends you $4,000, allowing you to control a total position worth $5,000 ($1,000 of your own capital + $4,000 borrowed).

2. If the market moves in your favor and your investment gains 50%.

3. Your $5,000 position would grow to $7,500.

4. After repaying the $4,000 loan to your broker, you would be left with $3,500. This translates to a net profit of $2,500 ($3,500 – $1,000 initial capital).

5. In contrast, without leverage, your $1,000 investment with a 50% gain would only yield a $500 profit. This example clearly demonstrates how leverage can multiply your potential gains significantly.

How Leverage Magnifies Losses: The Double-Edged Sword in Action

The flip side of leverage is its capacity to amplify losses just as dramatically as it amplifies profits. This is the core danger that makes leverage a “double-edged sword”.

1. Let’s take the same $1,000 initial investment with 1:5 leverage, controlling a $5,000 position.

2. Now, imagine the market moves against you, and your position suffers a 10% loss.

3. Your $5,000 position would lose $500, reducing its value to $4,500.

4. After repaying the $4,000 borrowed from your broker, you would be left with only $500 in your account.

5. This means a 50% loss of your initial $1,000 capital ($1,000 – $500 remaining). Without leverage, a 10% market downturn would have resulted in only a $100 loss.

This stark contrast highlights why leverage, while powerful, is also “dangerous and should not be taken lightly”. A small adverse price movement can lead to a substantial loss of your capital.

The Risks Associated with High Leverage

While the allure of significant profits is strong, the risks of leverage are equally potent and must be understood.

• Magnified Losses: As demonstrated, even a minor unfavorable market movement can lead to substantial and rapid losses, depleting a significant portion of your capital.

• Margin Calls: A critical risk for leveraged traders is the margin call. This occurs when the equity in your trading account falls below the minimum required margin level needed to keep your open positions. When a margin call is triggered, your broker will typically request that you deposit additional funds to cover the shortfall. If you fail to meet this requirement, the broker will automatically close your open positions, a process known as forced liquidation, to prevent further losses for both you and the broker. The maintenance margin refers to the ongoing funds required to cover any loss in the initial deposit’s value, ensuring it remains above a critical threshold.

• Psychological Impact: Trading with high leverage can exert immense psychological pressure due to the large position sizes relative to your actual capital. This can lead to impulsive decision-making, emotional reactions, and undue stress, negatively impacting trading performance and overall well-being. Some traders might seek this “emotional thrill,” but for many, the high stakes are detrimental.

• Losing More Than Your Initial Investment: In certain circumstances, particularly if your broker does not offer negative balance protection, it is possible to lose more money than your initial investment. This means your account balance could go into negative territory.

Forex Leverage vs. Other Markets: A Comparison

The application of leverage in Forex trading significantly differs from its use in other financial markets, such as stock trading, primarily due to the inherent nature of these markets and the leverage ratios typically offered by brokers.

• Higher Leverage in Forex: Forex brokers generally offer much higher leverage ratios (e.g., 50:1, 100:1, or even 200:1) compared to equity markets. In the stock market, retail investors typically receive leverage ratios around 2:1 or 4:1. Futures markets might offer slightly higher, around 15:1 leverage.

• Volatility Differences: The main reason for this disparity lies in the relative volatility of the underlying assets. Individual stock prices can fluctuate significantly in short periods, making high leverage much riskier. Currency pairs, while they move, generally exhibit smaller intraday price changes (often less than 1%) compared to equities, allowing brokers to provide higher leverage.

• Regulatory Frameworks: Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the U.S., impose stricter rules on stock margin accounts to mitigate excessive risk. The European Securities and Markets Authority (ESMA), for example, has set maximum leverage limits for Contracts for Difference (CFDs) to protect retail traders from excessive losses:

◦ 30:1 for major currency pairs (e.g., EUR/USD, GBP/USD).

◦ 20:1 for non-major currency pairs, gold, and main stock indices.

◦ 10:1 for other commodities and non-core stock indices.

◦ 5:1 for individual shares.

◦ 2:1 for cryptocurrencies.

• Margin Requirements: Forex trading typically requires lower margin percentages (e.g., 1% of the total trade size) to maintain a position, whereas stock trading often demands higher margins (e.g., around 50% of the position size for day traders).

Mitigating Leverage Risks: Smart Strategies for Traders

Leverage is a tool, and like any powerful tool, its effectiveness depends entirely on how it is used. The problem isn’t leverage itself, but rather employing it without sufficient knowledge or in an irresponsible manner. Here are crucial risk management strategies to help you harness leverage safely and effectively:

• Use Lower Leverage Ratios: One of the most straightforward ways to mitigate risk is to opt for more conservative leverage levels, such as 10:1 or 20:1, instead of using the maximum offered by your broker (which can sometimes be as high as 500:1). This reduces your exposure and the magnitude of potential losses.

• Set Stop-Loss Orders: Implement stop-loss orders on every trade. A stop-loss order automatically closes a position when the market price reaches a predetermined unfavorable level, effectively limiting the amount of loss you can incur on a single trade. This is a fundamental safeguard in leveraged trading.

• Limit Position Size: Control the amount of capital exposed in any single trade relative to your overall account balance. A popular guideline is the “1% rule,” where you risk no more than 1% of your total trading capital on any single trade. This ensures that no single adverse trade can significantly damage your entire account.

• Diversify Trades: Spread your trading capital across multiple currency pairs or different financial instruments. Diversification helps to reduce the impact of adverse price movements in one particular market on your overall portfolio, as losses in one area might be offset by gains elsewhere.

• Monitor Margin Levels Closely: Regularly check your account’s margin level. Being proactive allows you to identify if you are approaching a margin call and take corrective action, such as adding more funds or closing unprofitable positions, before forced liquidation occurs.

• Utilize Risk-Reward Ratios: Adopt a clear risk-reward ratio for each trade. For instance, you might set a rule to aim for a 2:1 ratio, meaning for every $1 you risk, you target at least $2 in profit. This strategy helps you to focus on trades where the potential reward justifies the risk taken, making your leveraged trades more strategically sound.

• Educate Yourself and Practice with Demo Accounts: Before engaging in live trading with real money, especially with leverage, invest time in thorough education and extensive practice. Demo accounts offer a risk-free environment, allowing you to simulate real market conditions using virtual money. This enables you to experiment with different leverage levels, understand market dynamics, and refine your strategies without the risk of losing actual funds.

Beyond Trading: Leverage in Business Economics

While crucial for traders, the concept of leverage extends beyond financial markets into business economics. Here, leverage is an index used to assess a company’s debt burden in relation to its total investments, quantifying its reliance on third-party financing.

• The formula in business economics is: (Equity Capital + Loans) / Equity.

• Interpreting this ratio:

◦ Equal to 1: Indicates that the company has no debt and relies solely on its own internal resources for financing.

◦ Between 1 and 2: Suggests that the funds received from third parties are balanced with the company’s own capital.

◦ Exceeds 2: Signifies that the company’s debt surpasses its equity or risk capital, indicating a higher level of financial risk.

Businesses often use leverage because raising capital through borrowing (especially long-term debt) can be less expensive than issuing new shares, as interest rates on loans are often lower than the dividends expected by shareholders. However, excessive financial leverage can increase the risk for creditors, potentially leading to higher interest rates for future loans. At a macro-economic level, high leverage can introduce systemic risk, where the failure of one highly leveraged entity can trigger a chain reaction, as seen during the 2008 financial crisis due to excessive leverage in the real estate market.

Conclusion

Leverage is undeniably one of the most powerful—and potentially dangerous—tools available to traders in the Forex market. It provides the incredible opportunity to multiply purchasing power and magnify profits, enabling traders to access larger positions with relatively small capital. However, this power comes hand-in-hand with significant risks, primarily the magnification of losses and the ever-present possibility of margin calls.

Successfully navigating the leveraged world of forex requires more than just a theoretical understanding; it demands a disciplined, well-informed approach to risk management. By diligently implementing strategies such as opting for lower leverage ratios, consistently setting stop-loss orders, carefully limiting position sizes, and practicing extensively with demo accounts, traders can harness the immense power of leverage while effectively safeguarding their capital.

Before you decide to use leverage in your trading, it is crucial to accurately assess your risk profile and ensure that leverage trading aligns with your personal financial objectives. Continuous education and consistent practice are your most valuable allies in becoming a responsible, proficient, and potentially profitable leveraged trader.